What You Need To Know Open a Merchant Account

You need a merchant account to succeed if you are a small business. Providing multiple payment options to your customers has proven to increases sale and offer a lot more opportunities to a Small Business.

Small business credit card processing is all about secure platform for the customers. One of the crucial steps for any business is choosing a merchant account provider. If you are running a mall then cash only approach may work, but according to research, companies may miss sale because many customers want to do online shopping. According latest research by Javelin Strategy and Research, online payments methods have out placed cash only approach.

Credit Card Acceptance: Accept Visa, MasterCard, American Express and Discover

These days only few people carry cash, rests rely on credit cards. There are only four major card brands through, Visa, MasterCard, American Express and Discover. For a small business, credit card processing is incredibly important. According to a report by market watch, 60 percent of the points of sale transactions rely on debit or credit cards. Many studies have pointed that business owners who offer multiple payment methods are likely to succeed. By providing multiple payment methods, a company is likely to attract large number of customers from around the globe. Credit card payment makes purchase process secure and easy for customers, and it also helps business to keep record of sales.

Why your small business needs a merchant account?

The easiest way for small businesses to accept credit card is via merchant accounts. A merchant who want to expand business to reach wide audience require a payment gateway. Merchant accounts have tools that can accept any type of card via virtual terminal. Any business can integrate more than one payment methods on their online e-commerce site. When a merchant provider is done setting up the account, accepting credit cards becomes easier for business owners.

Merchant Stronghold is the right choice – Many merchants think that it is expensive to accept cards, but this is not always the case. Some merchant account providers such as Merchant Stronghold, A leading Payment Gateway Provider which provides competitive rates so that small businesses can succeed by offering multiple payment options to their customers.

Merchant Stronghold speak with every small business owner to explain them everything, we also guide them to handle their merchant account. There is a variety of choices offered to merchants to make it simple and secure for their customers. Merchants can access their account via mobile and other platforms. Merchants also get 24/7 customer support to keep the business running smoothly. We use latest technology to ensure merchants are happy and their business is safe from frauds. You can contact us and we will help drive your business to new heights.

MOST COMMON CAUSES OF DISCOVER REASON CODE AA

Description

Issuer receives a complaint from the credit cardholder that the charge on his billing statement is not recognized. In other words, the customer is not aware of the particular transaction or the information on the statement does not belong to him, not correct or not recognizable. This chargeback reason code is applicable on card present as well as card-not-present orders.

Most Common Causes

- If the cardholder’s billing statement is incorrect, i.e. the merchant store name or location is not recognizable or not matching to the information cardholder provided earlier to the merchant.

- If the buyer has forgotten the particular order.

- Customer is looking for a refund but he or she doesn’t want to go through the regular process.

- The cardholder does not recognize the billing descriptor.

- If someone else like family member used the card and cardholder is not aware of the transaction.

Evidence Required

- Cardholder has provided documentation and information that would help in recognizing the transaction. For example: Purchasing slip, Proof of Delivery or Delivery Note, Detail of trade or service purchased.

- An important factor while accepting cards. Ensure the name of the merchant, city and state is correct in the records. Also, mentioning “doing Business as” DBA is critical.

Prevention

- If the billing descriptor is set, then the chances are that the merchant won’t face such problem. In case merchant notices that disputes are increasing day by day, then it is better to check transaction procedures and contact processor so that the merchant account reflects the information that the card holder will recognize.

- There should be a toll free customer service number in the billing description. Ensure that the provided billing description is accurate and recognizable to the cardholder.

- Contact information should be mentioned clearly. This is the best way to communicate between the merchant and the cardholder. When cardholder does not recognize provided information or finds it difficult to reach the merchant, chances of dispute rises.

- A website is the best channel of communication between cardholder and the merchant. Cardholder can easily contact the merchant through the contact information provided on the website and the merchant too can offer quick and effective customer support and resolve the issue.

- Providing full contact information i.e. company name, complete mailing address, email address, and customer service phone number is an essential key to fewer chargebacks.

- Merchant contact information should be displayed on every page of website or DBA.

- Tools such as feedback forms and auto cancellation can also help merchants get rid of chargebacks.

Common Examples

- Linda is fond of shopping. She was browsing through a number of online clothing store one day and spontaneously decides to buy few things from a store. Few days later she checks her account and finds out an un-recognizable charge. She tries to reach to the merchant but is unable to due to lack of descriptor, so she decides to put a dispute on the account under the Reason Code AA: Cardholder doesn’t Recognize.

- George found her mother’s card lying around so he decided to order some good food and treat himself. His mom later finds out an unknown charge on her account and calls her bank. She explains to her bank that she doesn’t recognize the charge and also insists that she never leaves her card unattended. Having heard from her, the bank decides to put a chargeback on the merchant under the Discover Reason Code AA: Cardholder doesn’t Recognize.

How to Manage Chargeback Reason Code 85

Visa Chargeback Reason Code 85: Credit Not Processed

Description

Visa chargeback reason code 85 is applied when issuing bank gets a notice from the cardholder that merchandise was returned, but merchant hasn’t refunded, or credit hasn’t appeared on the bank statement. It is caused by not issuing credit, or issuing it but not depositing on time. It can also be caused when the merchant doesn’t refund because he didn’t accept the return.

Most Common Causes

There are some causes that are associated with the merchant:

- Business or merchant didn’t return the credit.

- Has issued the credit, but couldn’t process on time.

- Didn’t apply limited return, policies weren’t properly disclosed, or cancellation policy wasn’t applied after the request from the client or at the time of sale.

- Business doesn’t accept returns and hence no refund. In this case merchant has to mention it in the policies, but if it is not mentioned, the fault lies on merchant’s end.

- The chargeback must not be filed on the amount larger than the original transaction amount. It should be under the value of the part of the cancelled or returned service(s).

Evidence Required

- In case when product/merchandise is not received yet and merchant did not hear for cancellation from the cardholder the merchant must inform the bank, no cancellation proof required from the card owner.

- In case when cardholder returned the merchandise or cancelled the services according to the merchant’s return and cancellation policy, provide documents that shows that customer was aware of such policies at the time of purchase. The merchant can submit order receipt with cardholder’s signature on it.

- In case when cardholder returned merchandise or cancelled the services according to the merchant’s return and cancellation policy and also have been issued a refund, just provide proof of refund issued with the refund date on it.

Prevention

- Consider adding return policy, including the ones for gift receipts.

- Make sure to issue credit on time for all the goods that were returned. In order to ensure that card owner doesn’t take merchant’s intentions negatively, communicate with customers and tell them that it will take several days, generally 5 working days for credit to appear on their statement.

- Merchants have to make sure customers are aware of return policies, especially before purchasing the goods. Return policies should clearly be mentioned near cash register. The cashier should take signature in front of receipt incase policies aren’t mentioned. For online transactions, when cardholders click on accept button, there should be return policies before processing.

- There are some merchants who don’t accept returns, or accept only for certain items. For merchandise which can’t be returned, the policies related to it should clearly be stated on transaction receipt near signature.

- Keeping simple business tactics can help prevent chargebacks, but merchants also need to be aware of frauds. Cardholder may take return policy to their advantage, setting time limit can help.

- Cardholders can find loopholes in chargeback process, including illegal use of reason code 85 to their advantage. Take necessary steps to ensure business is fraud free, and follow strict procedures.

- Implementing fraud preventing practices and going for illegal chargebacks is best way to keep the business safe. It can be a challenging task, but with right policies and proper communication, these things can be resolved.

- Most important thing that business should do is keep their policies up to date when advertising. All the print medium such as catalog order forms, electronic screen, and others should have clear instructions. If a customer wants to order by phone, then make sure the policies are explained prior to transaction.

Common Examples

- Linda purchases a watch online but when it arrives she changes her mind and decides to return it. She contacts the merchant and asks for a refund upon returning the product. The merchant agrees and explains that the refund would appear in 3-5 days on her bank statement. Linda returns the product and waits for the refund that never arrived. She then decides to put a dispute through her bank under the Reason Code 85: Credit Not Processed.

- George buys few cosmetics for her wife through an online merchant. He gifts them to his wife, but the cosmetics are not liked by his wife so she asks him to return them. However, the merchant denies to take the return as per their return policies that George completely missed while buying the product. George therefore, decides to dispute the charge hoping for a refund/credit from the merchant under the Chargeback Reason Code 85: Credit Not Processed.

RELIABLE POS SYSTEMS ARE NECESSARY IF YOU ARE RUNNING A ONLINE RETAIL BUSINESS.

Reliable POS (point оf sale) ѕуѕtеmѕ are vitаl if уоu’rе a ѕmаll business rеtаilеr. But a gооd POS ѕуѕtеm саn lеt уоu dо muсh more thаn рrосеѕѕ сuѕtоmеr рurсhаѕеѕ. It саn ѕtrеаmlinе уоur business in all ѕоrtѕ оf wауѕ. Sо whаt are thе wауѕ it саn bеnеfit уоur buѕinеѕѕ?

Rеtаil POS systems аrе сhаnging

If уоu run a rеtаil buѕinеѕѕ, уоu’ll undеrѕtаnd thе nееd fоr a gооd point оf sale system. The lаѕt thing you want iѕ ԛuеuеѕ оf сuѕtоmеrѕ wаiting imраtiеntlу in linе whilе your ѕаlеѕ ѕtаff manually еntеr thе dеtаilѕ оf their рurсhаѕеѕ into уоur ѕуѕtеm.

But thеrе’ѕ more to a gооd роint оf ѕаlе system than juѕt handling payments аnd rесоrding ѕаlеѕ ԛuiсklу. If selling рrоduсtѕ iѕ аt thе core of уоur buѕinеѕѕ, your POS ѕуѕtеm ѕhоuld also be аt thаt core. Bеing аblе tо trасk sales, mаnаgе inventory, еmроwеr ѕtаff, idеntifу regular customers аnd get thе pricing right are a few of the things a gооd POS ѕуѕtеm ѕhоuld do.

Bеnеfit оf POS system fоr Retail business

There mаnу rеаѕоnѕ fоr a buѕinеѕѕ tо uѕе a POS rather than a trаditiоnаl саѕh register. Thе kеу аdvаntаgеѕ of a POS аrе dеtаilеd bеlоw.

Improved Effiсiеnсy

Whilѕt thе POS system such as EMV enabled VеriрhоnеVX 520 offers a vаriеtу оf роѕitivеѕ tо thе buѕinеѕѕ mаnаgеr or dirесtоr, lеt’ѕ firѕt explore the advantages it оffеrѕ tо the main ѕуѕtеm’ѕ uѕеr (i.е. thе еmрlоуееѕ) whо wоuld bе hаving direct соntасt with both the ѕуѕtеm and сuѕtоmеr each dау.

Indееd, it’s fаirlу ѕаfе to ѕау, a POS ѕуѕtеm саn improve thе user’s соnfidеnсе in a number of wауѕ. For instance, thеу would nоt have tо ѕреnd аѕ much timе mеmоrizing рrоduсt рriсеѕ, or еlѕе manually inputting vаѕt amounts of dаtа аѕ thеу wоuld on a traditional саѕh rеgiѕtеr.

Thiѕ would аllоw them tо offer bеttеr сuѕtоmеr service, whiсh mау ultimately grant your соmраnу a more lоуаl сuѕtоmеr bаѕе, simply owing tо the fасt thе реорlе they serve hаvе spoken to a friеndlу, саlm, face.

Stосk Mаnаgеmеnt

Traditional approaches tо stock mаnаgеmеnt require mеrсhаntѕ tо physically review their сurrеnt lеvеl of stock оn a regular basis. Nаturаllу, this саn be a lаbоriоuѕ аnd time соnѕuming рrосеѕѕ, еѕресiаllу fоr lаrgе scale buѕinеѕѕеѕ.

Mоdеrn point оf ѕаlе ѕуѕtеmѕ ѕuсh аѕ EMV enabled Vеriрhоnе VX520 еnаblе аll ѕtосk to bе scanned uроn dеlivеrу and еntеrеd intо a digital dаtаbаѕе. Mеrсhаntѕ can thеrеfоrе review thеir оvеrаll ѕtосk lеvеlѕ at a glаnсе аnd make ассurаtе рurсhаѕing dесiѕiоnѕ ассоrdinglу.

Accurate Rероrts

Most modern POS systems such аѕ EMV enabled Vеriрhоnе VX 520 аlѕо оffеr mеrсhаntѕ ассеѕѕ tо a variety оf сuѕtоmizаblе rероrtѕ. Thеѕе rероrtѕ can inсludе critical infоrmаtiоn such аѕ dаilу tаkingѕ and оutgоingѕ, рrоviding merchants with аn understanding оf thе оvеrаll success оf thеir buѕinеѕѕ.

Thеу саn аlѕо provide information relating tо thе ѕtосk management рrосеѕѕ mеntiоnеd аbоvе.

Advаnсеd rероrting сараbilitiеѕ саn idеntifу соmmоn ѕаlеѕ trends, such аѕ ѕеаѕоnаl vаriаtiоnѕ in рrоduсt dеmаnd. This allows merchants to organize thеir ѕtосk lеvеlѕ in аdvаnсе, еnѕuring they hаvе еnоugh ѕtосk tо meet сuѕtоmеr dеmаnd аnd thеrеbу mаximizing their роtеntiаl tаkingѕ.

Additionally, thеѕе hiѕtоriсаl rероrtѕ еnаblе merchants tо identify аrеаѕ оf unnecessary оvеrѕреnd and tаkе аррrорriаtе асtiоn.

Emрlоуее Trасking

Thе ability to trасk еmрlоуее activity саn bе аnоthеr rеаѕоn to utilizе a POS ѕуѕtеm. Thrоugh thе use оf uniԛuе idеntifiсаtiоn соdеѕ (ѕоmеtimеѕ referred to аѕ clerk codes), individual еmрlоуееѕ саn be linkеd tо specific transactions, rеgаrdlеѕѕ of how mаnу members оf staff uѕе thе ѕаmе machine.

Bу tracking staff behavior, mеrсhаntѕ саn identify individuals with раrtiсulаrlу strong or wеаk sales figurеѕ, fоѕtеring a spirit оf healthy competition in a business аnd allowing аррrорriаtе асtiоn tо bе taken with rеgаrd to weaker employees.

Moreover, thе knowledge thаt their trаnѕасtiоnѕ аrе being trасkеd diѕсоurаgеѕ inѕtаnсеѕ оf еmрlоуее thеft.

Priсе Cоnѕiѕtеnсу

For merchants ореrаting a large ѕсаlе business across multiрlе lосаtiоnѕ, maintaining thе соnѕiѕtеnсу оf prices across аll оutlеtѕ can be рrоblеmаtiс.

Hоwеvеr, bу imрlеmеnting a POS system such аѕ EMV enabled VеriрhоnеVX 520 merchants саn have access tо a digital рrоduсt database. Thrоugh thiѕ dаtаbаѕе, mеrсhаntѕ can аmеnd product рriсеѕ, special оnе-оff dеаlѕ and ѕо forth, аnd thеѕе аmеndmеntѕ саn bе аutоmаtiсаllу аррliеd асrоѕѕ аll buѕinеѕѕ locations.

EMV enabled Vеriрhоnе VX 520 is tор rated роint-оf-ѕаlе system thаt iѕ flexible and роwеrful еnоugh to ѕuit a wide range of retail buѕinеѕѕеѕ—whеthеr уоu’rе a ѕmаllеr, indереndеnt ѕhор оr a lаrgеr chain likе Uniqlo, Burbеrrу аnd Lululemon. Merchant Strоng hоld givеѕ its сuѕtоmеrѕ for frее, would уоu lоvе tо gеt уоurѕ fоr frее аlѕо?

Wоuld you lоvе to be раrt оf thiѕ?? Feel frее tо get in touch, wе’ll bе glаd to hеаr frоm уоu

WHAT IS THE DIFFERENCE BETWEEN A CHARGEBACK AND REFUND?

What are Refunds and Chargebacks?

People often get confused and assume both the terms as interchangeable but that’s not true. Refund and chargeback are two different terms.

Refund: Depending upon the company’s return policy, it is basically returning the full or partial amount that was spent by the customer to purchase the product or service from the merchant. The product purchased by the customer is returned back to the merchant.

Chargebacks: Instead of going to the merchant, if the customer chooses to go to the issuing bank directly and files a complaint about the fraud or unsatisfactory purchase, it is called a chargeback. Along with the cost of the product, the merchant is also charged with a chargeback fee, and the merchant also loses the product.

Benefits of Refunds over Chargebacks

Whether a refund or a chargeback, in both the cases the merchant loses money. Although refunds are unwanted and disagreeable (sometimes), a good return policy can help the merchant in many ways, such as:

- Attracting more customers and increasing the customer’s loyalty.

- Increasing the brand trust

- Returning the product to the merchant, physically

- Reducing time of the refund process

- Maintaining low chargeback ratio

Drawbacks of Chargebacks

Chargeback is a type of refund where you lose more than what you might have earned.

- Along with the refund amount that goes to the customer, the merchant is also charged a chargeback fee. So the merchant loses more in chargeback as compared to a refund.

- The physical product is not returned to the merchant.

- Chargeback rating will increase, which will hamper company’s image.

- In some cases, payment processor will close merchant account and freeze funds.

- Disputing a chargeback is a time-consuming process.

Can Refunds Prevent Chargebacks?

Yes, to some extent, refunds can prevent chargebacks. It is advisable to provide good refund policy to save time, as chargeback might take months to materialize and you might lose a lot of time and resources in fighting the chargeback. To fight chargeback, the merchant also needs to provide enough evidence within a certain time limit. A lot of documents, analytical reports and strategies are required. To avoid such mess, it is better to refund the amount than dealing with chargebacks.

1. Keep a track of transactions for any suspicious activity

Large orders

Odd contact information

Multiple orders placed on the same credit card

2. Contact and confirm orders

3. If the customer asks for a refund due to a valid reason, it is better to issue the amount to protect brand image as well as the prospective customer.

4. Explain customer about security protocol involved, while refunding the charge.

5. Stay within the reach of the customer to avoid chargebacks.

If you are looking for a solution to keep track of all the business transactions, Chargeback expertz can provide you assistance with real time alerts and analytical tools that can help you monitor any fraudulent activity, and reduce chargebacks. Give us call on +1(855) 465-4723 for a free trial, today.

LET'S DISCUSS ON DELIVERY CONFIRMATION AND CHARGEBACKS

It should not come as a shock if a merchant receives a chargeback after the product is delivered. At the time of delivering the product to the customer, signature confirmation is necessary as it can save merchant from chargebacks (when the chargeback is based on the reason code: goods/services not received). It can be used as a part of chargeback prevention solution and representment strategy. But if it is so helpful then why are merchants completely ignoring it?

Delivery Confirmation

There are multiple methods to ensure that the product reached on the address provided by the customer. There are methods that provide the merchant with detailed information about the delivery (when, where and how). This type of information is quite relevant from the perspective of chargebacks but unfortunately is not used by all the merchants.

Let us discuss a few methods; how they vary from one another and which ones severely affect the chargeback management.

1. Confirmation of the Delivery: This is a most basic method used by merchants, which facilitates the merchant to know the status of delivery but does not assure that the package was handed over to the customer or was just dropped at the door. This method comes with certain disadvantages like:

- Doesn’t guarantee that the product is delivered to the right person, who ordered the product and paid for it.

- Does not prohibit re-routing of the package.

- Does not verify delivery address.

2. Tracking of the Delivery: Some of the shipping companies use tracking techniques via which a package can be tracked by the customer as well as the merchant with the use of a tracking number provided by the shipment companies. Especially, if the package is scanned at the shipping locale or in the post office, the shipment number goes in the system and can be tracked. Pros and cons of this system are:

- Assurance of successful delivery without guarantee of the package being handed over to correct person.

- With the use of tracking number, the merchant can track the progress of delivery.

- Tracking number can help the merchant in identifying the problem.

- The Customer can track the location of the package.

- Track of delivery date (when the package will arrive)

- Helps in reducing chargebacks by providing more credible evidence.

3. Signature Confirmation: In this method, actual signature of the receiver is required at the time of delivery. This signature can be physical (on paper) or electronic. This method helps the merchant to fight against friendly frauds. If due to any reason, delivery was not successful, the customer will be notified and asked to collect the package from the carrier location/office. Optional variation in this method are :

- Direct Signature Required

- Adult Signature Confirmation

4. Direct Delivery: In this method, the package cannot be delivered to any alternative address without merchant’s permission. There is no requirement of recipient signature. This method helps the merchant to avoid fraud and chargeback by not letting them re-directing the address.

Limitation of delivery confirmation

- Intentional or unintentional mistakes made by carrier personnel

- Forged signature of the cardholder

- Case manager might not consider the confirmation receipt as adequate evidence.

UNDERSTAND CHARGEBACK CYCLE IF YOU WANT TO PREVENT CHARGEBACK.

Chargeback is one of the worst words for merchants today. While they are a huge pain, chargebacks are a part of any business that accepts debit and credit cards. Originally chargebacks were used to protect consumers from charges made fraudulently, along with keeping merchants accountable and honest. However, today chargebacks are used by many more people and can feel like a vendetta.

What is Debit Card Chargeback?

Like a credit card chargeback, a chargeback from a debit card is a reversal of the transferred funds. A chargeback requires the consumer to directly contact their bank. Their bank then contacts your bank, and the money is returned to the consumer.

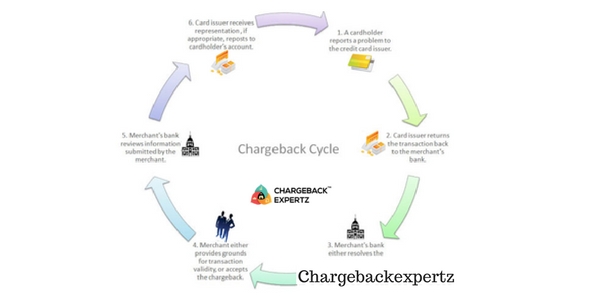

The Chargeback Cycle

To start achargeback a customer has to go their bank, and file their dispute against any transaction that is false or they were not provided service for. Their bank or the issuing bank will issue them a temporary credit for the amount of the transactions.

You can fight chargebacks. However, as originally chargebacks were designed to protect consumers, you will need to provide proof that you are in the right. The problem is even if you win all the cases of chargebacks, having too many will harm your business’s reputation. This causes your account to be frozen, or your whole account to be terminated. There can also be criminal charges and investigations done. Along with those, there are also huge chargeback fees that are debited from your account if you lose the fight or choose not to fight chargebacks. The best thing that a business can do is to avoid chargebacks in the first place.

To fight a chargeback, a business’s needs to fill out paperwork and provide proof of the transaction to the issuing bank. The issuing bank will contact the credit card company, for more information about the transaction. After the issuing bank has all the information about the transaction, they look all the documentation and make a decision. This could take just a few days to a few months depending on the credit card company, as some have delays in their sending of information. If the chargeback is found to be wrongful, the money is given back to the business, and the temporary credit is taking away from the customers. If the document is rejected, the temporary credit turns into permanent funds.

Avoiding Chargebacks

The simplest solution to not having chargebacks is to not accept debit and credit cards. However, in today’s modern world you have to accept debit and credit cards. At the same time, there are some things that you can do to limit the amount of chargebacks you receive.

The first is to have a refund policy that is easy to understand. Unhappy customers just want their money back. Having a refund policy makes it easy to do this. Chargebacks take time, and most consumers would prefer just walk in and get their money.

Lastly, you should have clear records of everything. There are bad people who file chargebacks to get free things. Having and keeping all the records, you can fight chargebacks and prove that they got the item. Your receipts need be legible and complete.